child tax credit september payments

September 17 2021. Update on September advance Child Tax Credit payments.

Not Eligible For Child Tax Credit Got My Return This Year And Claimed My Daughter Who Was Born In September I Don T Understand Why I Wouldn T Be Eligible I Seem To Qualify

Users will need a copy of their 2020 tax return.

. That glitch affected about 15 of the people who were slated to receive direct deposit payments for the August Child Tax Credit money. Sep 25 2021 1242 PM EDT. John Belfiore a father of.

The credit amount was increased for 2021. Millions of families across the US will be receiving their third advance child tax credit. Total child tax credit payments between 2021 and 2022 could be up to 3600 per kid.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax. Filed a 2019 or 2020 tax return and. Claimants must have received a payment - or an annual award of at least 26 for the 2022-23 tax year - from August 26 to September 25.

To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. Sep 25 2021 0144 PM EDT. Well tell you when this payment will arrive and how to unenroll.

Your payment will be mailed to you or deposited into your bank account if youre signed-up for direct deposit. If your December child tax credit check or a previous months check never arrived well tell you how to trace it. Only one child tax credit payment is left this year.

Who is Eligible. In September the IRS successfully delivered a third monthly round of approximately 36 million Child Tax Credit. Families can receive 50 of their child tax credit via monthly payments.

The Child Tax Credit Eligibility Assistant lets parents check if they are eligible to receive advance Child Tax Credit payments. We have resolved a. Child tax credit.

If youre wondering when your September Child Tax Credit payment will arrive youre not alone. The ARP increased the 2021 child tax credit from a maximum of 2000 per child up to 3600. Likewise if a 17-year-old turns 18 in 2021 the.

The next child tax credit payments will start arriving on September 15. Msn back to msn home money Skip To Navigation. That means if a five-year-old turns six in 2021 the parents will receive a total credit of 3000 for the year not 3600.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for. Many parents are wondering the same thing. Under the American Rescue Plan Act of 2021 we sent advance Child Tax Credit payments of up to half the 2021 Child Tax.

2 days agoTax credits. Heres what we know. Whether or not another IRS glitch.

When will the second. Late September payments on the way IRS says by. The monthly child tax credit payments of 500 along with the pandemic unemployment benefits were helping keep his family of four afloat.

Advance Child Tax Credit Payments in 2021. The American Rescue Plan increased the amount of the. Last week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits totaling 15 billion.

September 24 2021. Under the American Rescue Plan most eligible families received payments dated July 15 August 13 and September 15. This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15 billion.

Subsequent stimulus checks will be sent to households on October 15 November 15 and. Payments will be issued automatically starting November 4 2022.

September Child Tax Credit Payments Being Sent To 35 Million Families

Child Tax Credit Payment Schedule For 2021 Kiplinger

September Child Tax Credit Glitch Youtube

Next Child Tax Credit Deadline In Just Two Weeks As 300 Payments For September Are Sent Out The Sun

Brproud Irs Issues Warning As Next Batch Of Child Tax Credit Payments Are Set To Go Out Next Month

Child Tax Credit Portal Glitch Delayed Some September Payments Don T Mess With Taxes

Child Tax Credit 2021 When Is Deadline To Opt Out From The September Payment As Usa

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

Tax Tip Irs Statement On September Advance Child Tax Credit Payments

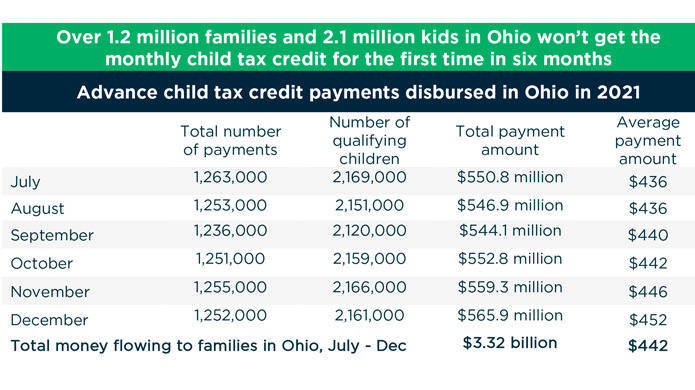

What S At Stake For Families As The Monthly Child Tax Credit Payment Ends Ohio Capital Journal

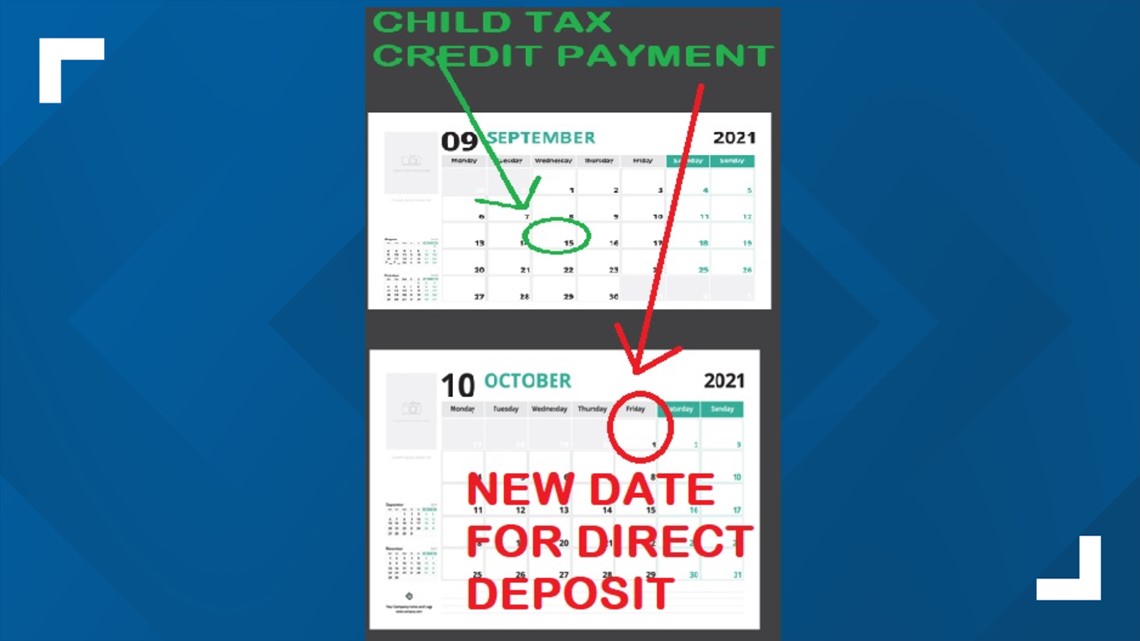

Why Your September Child Tax Credit Payment Is Delayed Wset

Should You Opt Out Of The New Advance Child Tax Credit Payments Here S What You Need To Know Allmomdoes

Child Tax Credit New Update Address Feature Available With Irs Online Portal Make Other Changes By Aug 30 For September Payment Linden Nj News Tapinto

How Can I Enroll A Child Born In 2021 For The Child Tax Credit Payments As Usa

Some Parents Are Missing The September Child Tax Credit Payment Boston News Weather Sports Whdh 7news

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

September Child Tax Credit Payments How To Fix Mistakes Money

Missing September Child Tax Credit Payments Some Parents Have Yet To Receive The Funds Cnn Politics

Irs Delays Some September Child Tax Credit Payments Until Oct Wfmynews2 Com